- VP of Operations

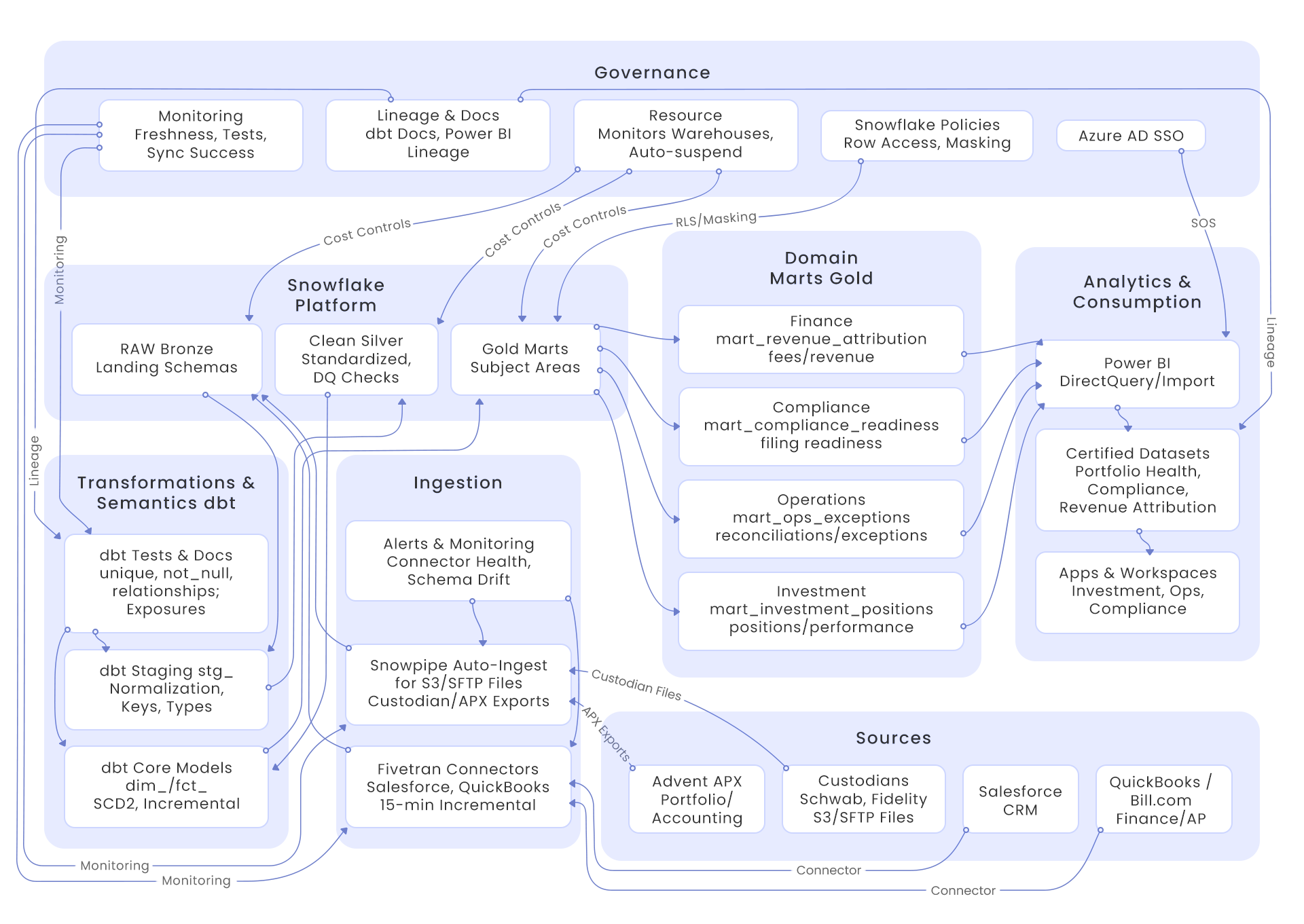

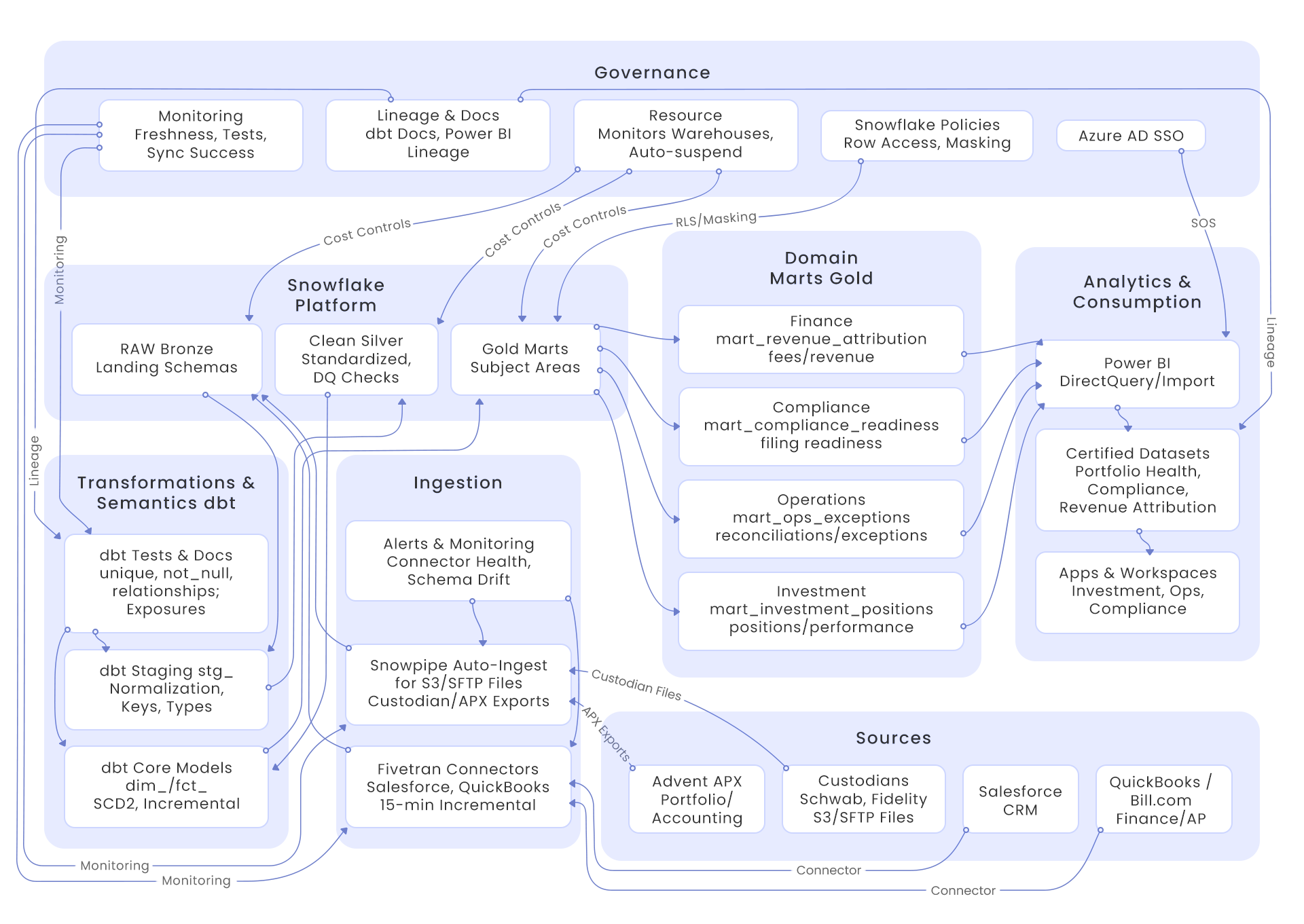

Architecture

A mid-market SEC-registered investment adviser modernized its data platform to deliver near real-time portfolio visibility and governed reporting. Using Fivetran for automated ingestion, dbt for modular transformations and semantic modeling, Snowflake for elastic warehousing, and Power BI for governed self-serve analytics, the firm consolidated APX, custodian, CRM, and finance data into trusted marts. The implementation cut quarterly reporting cycle time by half, reduced defects by over 90%, and improved compliance readiness, while lowering pipeline maintenance and improving adoption.

We implemented a Snowflake-centered analytics platform with managed ingestion and modular modeling for reliable pipelines and governed, performant BI.

| Staging | stg_apx_tradesstg_apx_positionsstg_custodian_positionsstg_salesforce_accountsstg_quickbooks_invoices |

|---|---|

| Core | dim_client (SCD2)dim_account (SCD2)dim_securityfct_tradesfct_positions_dailyfct_cash_ movementsfct_revenue |

| Marts | mart_investment_positionsmart_performance_overviewmart_ops_exceptionsmart_compliance_readinessmart_revenue_attribution |

| Monitoring | met_data_freshnessmet_dbt_test_resultsmet_reconciliation_status |

Our quarterly statements now close in days, not weeks—and the investment team trusts the numbers. We gained real-time visibility without adding maintenance overhead.

Real-World Results from Satisfied Clients Across Key Industries